Ways To Have Your Federal Student Loan Forgiven, Canceled And Discharged

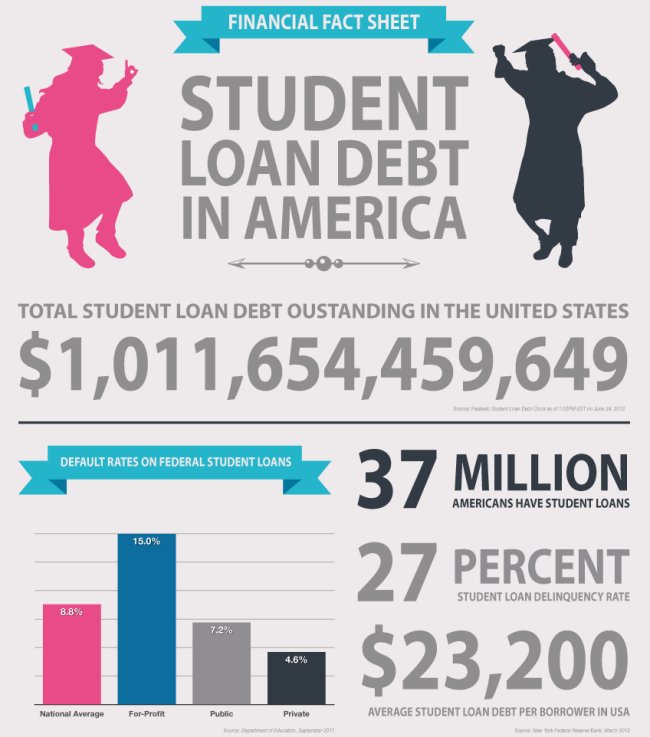

Student loans debt is in America is a major problem. With over a trillion is current student debt, it may feel like their is no way out. Whether you don’t find a job, don’t finish school or are dissatisfied with what you studied with the help of student loans, repayment of your loan is a must. There are however certain circumstances where you may be able to get your loan forgiven, canceled or discharged! These common types of loan forgiveness, cancellations and discharges include:

Closed school discharges

Borrowers are eligible for this discharge if they meet the following criteria:

Your school closes within 120 days after withdrawal

Failure to complete your education program due to your school’s closure during your enrollment

If you make withdrawals more than 120 days before school closure, have completed all the coursework regardless of whether you got your diploma or degree, or complete comparable educational program in another school, you don’t qualify for a closed school discharge.

Discharge in bankruptcy

Although a rare case, federal student loans may be forgiven if a borrower can prove beyond reasonable doubt that they are bankrupt. Should you file for the Chapter seven (7) or Chapter 13 bankruptcy, your loan may be discharged if the court determines that the loan payments would impose hardships on yourself and people depending on you.

False certification of student eligibility or unauthorized payment discharge

You may be eligible for this discharge under the following conditions:

- Your loan was falsified because you were a victim to identity theft

- The school endorsed your loan check and signed authorization for transfer of fund without your knowledge

- Your school certified your eligibility, but due to some other reason like a criminal record or mental condition, you are disqualified for employment in what you trained for

- Your school falsely certified your eligibility to receive a student loan

Total and permanent disability discharge

This discharge relieves you from having to pay a Direct Loan, a Perkins Loan a TEACH grant service obligation or a Federal Family Education Loan. To qualify, you have to submit information to the US Department of Education proving that you are permanently disabled. Some of the ways you can use to prove your disability include:

- Submit a Social Security Administration Award for SSI or SSDI benefits stating that you are scheduled for a disability review within 5-7 years from your most recent SSA disability review

- Submit a certification from a physician stating that you are permanently disabled

- Submit documentation from the US Department of Veterans Affairs states that you are unemployable due to a service connected disability

Death discharge

A federal student loan is most likely forgiven if the borrower dies. If you happen to be a parent PLUS loan borrower, your loan will be discharged in the event of your death or that of the student you borrowed on behalf of. A family member or another representative, however, has to present the death certificate to the school or loan servicer.

Unpaid refund discharge

In this case, the borrower’s loan is discharged if they withdrew from the school, but the school failed to pay refunds owed to the US Department of Education or the lender. However, this is only a partial discharge as you are forgiven for the amount of the refund.

Public loan service forgiveness

If you have made at least 120 payments on your direct loan and are employed in the public sector, what remains of the loan may be forgiven. You can’t be in default on loans and must have made payments in certain plans over the period of 120 days to qualify.

Teacher loan forgiveness

If you are a teacher who’s been teaching full-time in a secondary school or an elementary school or an educational service agency for at least five years consecutively, you may have as much as $17,500 of your loans forgiven. PLUS loans are not included in this discharge.

As you can see, provisions for different discharges differ depending on the type of loan. It’s also important to note that not every cancellation is available to everyone. For instance, some are available to military personnel, others to borrowers affected by the closure of schools and others to teachers. Until it’s made official that your loan has been forgiven, you are required by law to continue making payments. If you qualify, you are not under the obligation to keep making loan payments. In the event that your discharge is denied, it’s highly unlikely that you’ll be allowed to appeal. The only circumstances under which you may be allowed to appeal include forged signature and false certification discharges. Otherwise, you remain eligible for your loans.